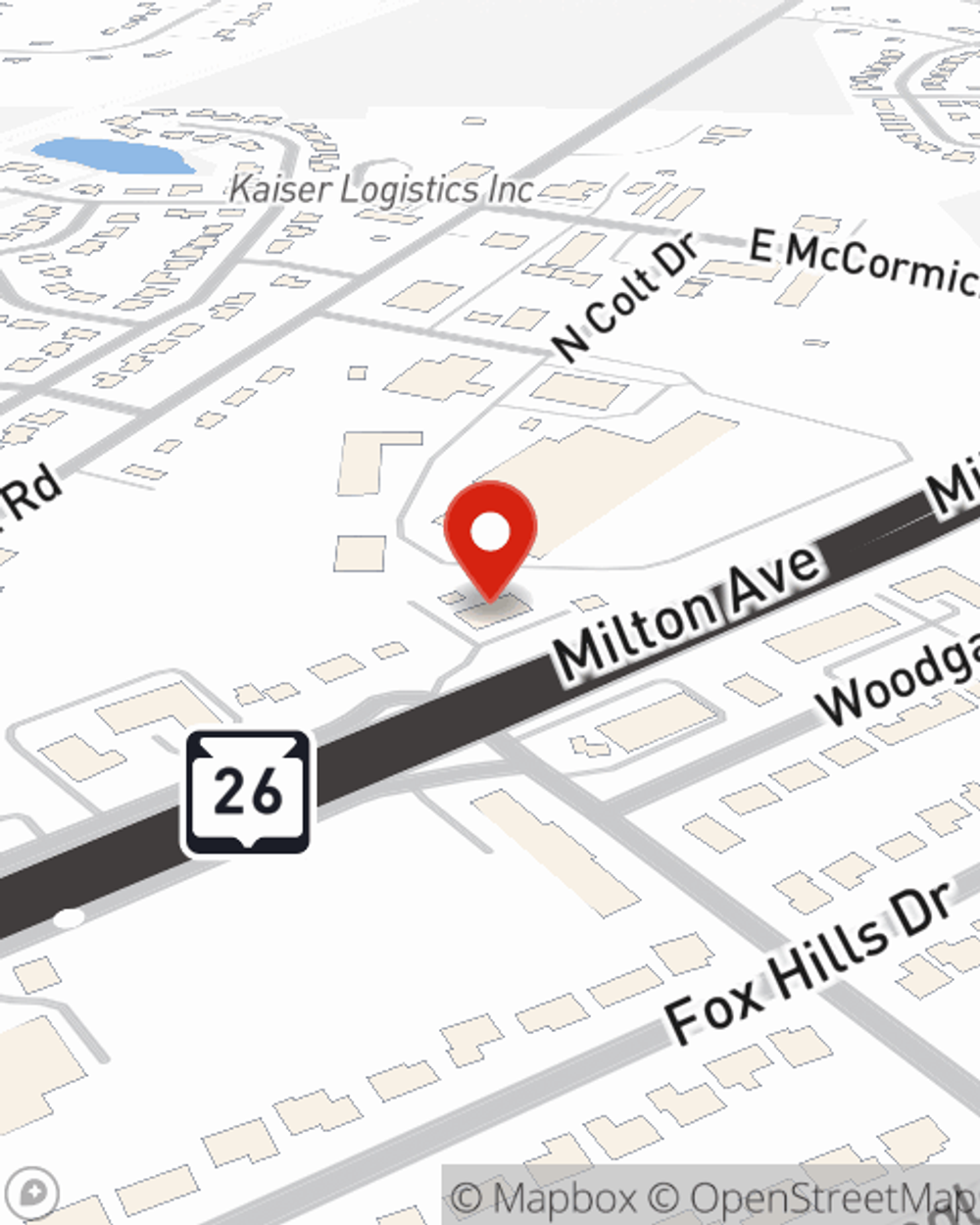

Business Insurance in and around Janesville

Calling all small business owners of Janesville!

This small business insurance is not risky

- Janesville

- Milton

- Fort Atkinson

- Beloit

- Orfordville

- Footville

- Jefferson

- Edgerton

- Rockford

- Whitewater

- Evansville

- Johnson Creek

- Monroe

- Roscoe

- South Beloit

- Brodhead

- Watertown

- Cambridge

- Madison

- Sun Prairie

- Milwaukee

- Oconomowoc

- Delafield

Your Search For Remarkable Small Business Insurance Ends Now.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like extra liability coverage, errors and omissions liability and a surety or fidelity bond, you can feel confident that your small business is properly protected.

Calling all small business owners of Janesville!

This small business insurance is not risky

Surprisingly Great Insurance

When you've put so much personal interest in a small business like yours, whether it's a lawn care service, an arts and crafts store, or a tailoring service, having the right protection for you is important. As a business owner, as well, State Farm agent Katie Myers understands and is happy to offer personalized insurance options to fit what you need.

Call Katie Myers today, and let's get down to business.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Katie Myers

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.